Mid-market businesses less optimistic, despite record numbers expecting increased profitability

The challenges of navigating the global economy have been highlighted by a record number of mid-market business leaders expecting an increase in profitability (up one point to 60%) coinciding with a drop in optimism (down two points to 65%), according to Grant Thornton’s latest International Business Report (IBR).

A closer examination of the data offers some explanation of this apparent contradiction.

The record number of businesses expecting an increase in profitability is most likely due to inflation being brought under control. This is highlighted by a five-point drop (down to 50%) in the number of businesses expecting to increase their selling prices over the next 12 months. Every business constraint tracked in the IBR has also eased, indicating less pressure on margins. For example, those citing labour costs as a constraint is down two points to 51%, those citing energy costs as a constraint is down two points to 52%, and those citing a shortage of finance is down four points to 40%.

Elsewhere, concerns over a shortage of orders has dropped five points to 43%; concerns over red tape and regulation is down four points to 47%; and concerns over availability of skilled labour is down three points to 50%.

While these numbers have dropped, most have dropped marginally and still remain well above average since the IBR research began.

However, there is little doubt that the relentless pressure on margins may finally be easing, as seen by a four point drop in the number of businesses expecting to provide real salary increases over the next year (down to just 19%). This may also explain the marginal increase (up one point to 50%) in the number of businesses expecting to increase the number of people they employ.

But there is no escaping the gloomy geopolitical landscape. Despite a marginal drop of one point, economic uncertainty remains the most frequently cited constraint, by 57% of mid-market business leaders.

That uncertainty has spilled over into a less optimistic outlook for international trade. Business leaders expecting to increase exports has dropped four points to 43%. This is driven by a three point drop (down to 40%) in the number of leaders expecting to increase the number of countries they sell to and a two point drop (down to 42%) in those expecting to increase revenue from non-domestic markets. Perhaps the record number of countries voting in elections and the potential regulatory and geopolitical upheaval that may cause might be tempering the international ambitions of business?

And while profit expectations are up, the one point rise is matched by a one point drop in those expecting to see an increase in revenues over the next 12 months – down to 59% of respondents.

This expectation may be flowing through to marginal falls in business investment expectations. However, investment in technology remains top of the list with no change in proportion of leaders (61%) expecting to increase investment in this area. Elsewhere there is a one point drop in investment in staff skills (down to 56%), a two point drop in investment in research and development (down to 52%), no change in investment in plant and machinery at 46%, and a two point drop (down to 36%) in investment in new buildings.

Peter Bodin, CEO of Grant Thornton International commented:

“Our latest IBR highlights the complexity and difficult choices that business leaders face. Does improving profitability mean an opportunity to focus on growing market share through changes in pricing strategy? Do persistent concerns over economic uncertainty and continuing geopolitical challenges signal a need to prepare for more volatility? And does an improving inflation outlook and falling interest rates mean better financing options? As always, it depends. It depends which market you are in. It depends what condition your business is in. It depends on the competitive landscape in your industry.

Despite lower levels of optimism, it is not all doom and gloom – but neither is it getting any easier to choose a clear path. With the global economy in a lower growth trajectory, the decisions made by business leaders will have a far bigger impact on whether companies are successful or not. As our data highlights – making the right choices is not getting any easier. Navigating these challenges is something we expect clients will continue to need help with.”

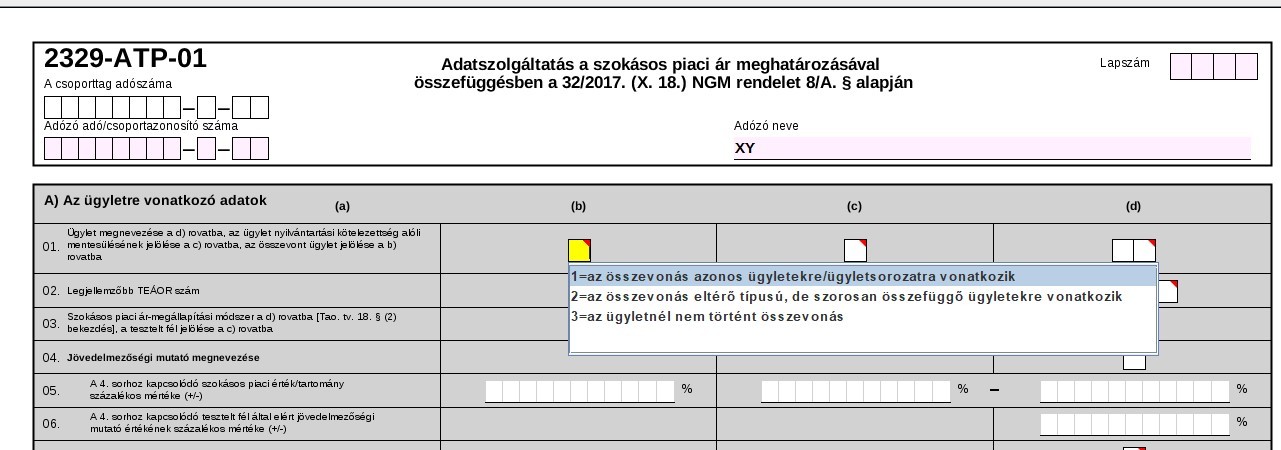

An important change in connection with transfer pricing is the change in the data content of the transfer pricing information sheets (ATP sheets) of the recently published Form 2329 corporate tax return (Form 2329).

Indication of a consolidated transaction

As of 31 December 2022, purchases cannot be combined with sales of goods manufactured from purchased materials, nor can transactions involving expenses be combined with a transactions primarily involving revenues. Therefore, in their 2023 corporate tax return, taxpayers are required to indicate whether there was such combining in case of the transaction examined, and if so, whether the combining relates to identical transactions or to different types of closely related transactions.

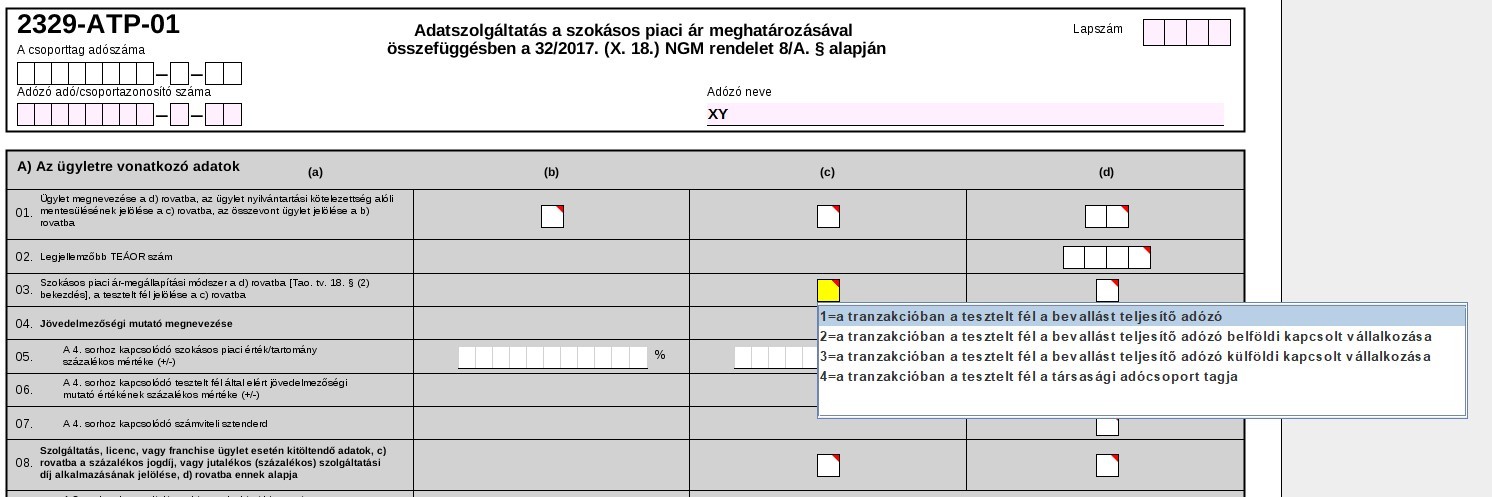

Indication of the tested party

A new element is the requirement for the taxpayer to indicate on the tax return which party is considered to be the tested party for the transaction.

Cases of cost charging

Transactions relating to the charging of the consideration for the supply of goods or services from an independent party exempted under Section 1(2), point c) of Ministerial Decree 32/2017 NGM to a related company or companies in the same value are already subject to a limited reporting obligation for the financial year 2023.

The instructions for completing Form 2329 are expected to be clarified due to the reference to Form 2429EUD.

The purpose of this post is to draw attention to the fact that this issue will have to be dealt with in the future according to a different set of criteria and that it is feared that in many cases the time available will not be sufficient if, for example, transactions in opposite directions have been combined previously.

We encourage you to review your current transfer pricing processes, and if you wish to involve experts, please do not hesitate to contact us.

The Global Minimum Tax Act has brought about a change in the area of notified shares, which could be favourable for many taxpayers. In this newsletter, we will examine the details of the above.

The concept of notified shares

In business life, particularly since the COVID epidemic, it is common for a (domestic or foreign) company to acquire some form of shareholding in another company. There is a corporate tax base relief linked to notified shares, i.e. the notification of the shareholding thus acquired, to the Hungarian tax authority (NAV). Upon the sale (or transfer) of a notified share held for at least one year, the corporate tax base may be reduced by the capital gains realised on the sale of the share. At the same time, it is also true that the amount of any capital loss on the sale increases the corporate tax base.

However, the (favourable) rules detailed above do not apply to shares acquired in what is called a “controlled foreign company” (CFC).

Prior to 1 January 2018, the relevant legislation also included a minimum acquisition rate (10%), and to qualify for the corporate tax base relief, a shareholding of at least this extent had to be acquired. This rule has since been abolished, and even a small shareholding acquisition can now be notified to NAV.

However, the deadline for reporting is time-barred: taxpayers have 75 days from the acquisition to notify the tax authority.

Favourable change from 31 December 2023

The transitional rule included in the Global Minimum Tax Act promulgated at the end of last year is linked to this notification deadline: in derogation from the 75-day deadline, taxpayers concerned may notify to NAV any shareholding acquired before 31 December 2023 until the deadline for filing their corporate tax return for the tax year 2023. The condition for filing a notification is that the share notified must meet the definition of notified shares in the Corporate Tax Act at the time of filing (i.e. not at the time of original acquisition).

The (also time-barred) deadline for taxpayers whose business year coincides with the calendar year is therefore 31 May 2024 (Friday), to report to NAV any shareholdings that they had acquired earlier but failed to report within 75 days.

However, this extended deadline is subject to certain additional conditions:

- Firstly, 20% (one-fifth) of the difference (gain) between the market value and the book value of the newly notified shares on 31 December 2023 is added to the corporate tax base, on which the 9% corporate tax must be paid by the deadline for filing the corporate tax return for the tax year 2023.

- Taxpayers must also provide an independent auditor’s or expert’s report to substantiate the market value of the shareholding.

- A separate record must be kept in connection with the notification.

The transitional rule on notified shareholdings is most useful for corporate taxpayers who plan to sell all or part of their previously acquired shareholdings after one year and expect to realise a gain on those shares.

* * *

If your company has a stake in another company acquired before 31 December 2023 that was not declared to the tax authorities within the 75-day time limit, if you have further questions about the definition of a declared stake, or in case you need an expert opinion on the market value of the stake, Grant Thornton’s tax experts and asset appraisers are pleased to assist you and your company.

This newsletter is based on the information available at the date of its publication and is written for general information purposes only; therefore, it does not constitute or replace personalised tax advice in any respect.

On 1 January 2024, the new system for the recollection of beverage packages, the so-called Deposit and Return System (DRS), entered into force in Hungary, and in connection with this, certain rules applicable to value added tax (VAT) were also changed effective from 1 January 2024. In this newsletter we briefly describe the key features of the DRS and the related VAT changes.

DRS rules in a nutshell

The Hungarian background legislation on DRS can be found partly in Act CLXXXV of 2012 on Waste, with more specific provisions laid down in Government Decree 450/2023 (X. 4.) on the detailed rules for the establishment and application of the deposit return system and the distribution of products subject to the deposit return system (hereinafter “Government Decree”).

Although the rules provided for compulsory registration as of 15 November, the system only went live from 1 January. As can be seen from the above-mentioned legislative background, like the Extended Producer Responsibility (EPR) system (which we have discussed in several newsletters (here, here and here), DRS is also a waste management regulation. They are also similar in that both are transpositions of EU regulations into domestic law and, in addition, the same company, MOHU MOL Hulladékgazdálkodási Zrt. (MOHU) is responsible for the operation of both systems.

The Government Decree distinguishes between producers, the concession company (MOHU), distributors (shops) and end-users (consumers) in relation to the DRS.

What are product subject to mandatory DRS?

Under the Government Decree, products subject to mandatory DRS are defined as beverage products (ready-to-drink or concentrate) in containers of 1 decilitre (0.1 litre) or more, up to a maximum of 3 litres, distributed directly to consumers in the form of a bottle or can (regardless of reusability; although, as we will see, reusability is also relevant), in plastic, metal or glass containers. The definition of a beverage product is not included in the Government Decree, and therefore, according to the common “interpretation” of the category, products sold in liquid form and typically consumed by drinking are considered to be such products.

As is usually the case, there are exceptions, to which the DRS does not apply: one such exception is the category of milk and milk-based beverage products. In addition, the Government Decree also sets a lower quantitative limit: if a manufacturer’s sales of the products in question subject to the DRS do not exceed 5,000 units (small quantities) in a reference year, the economic operator concerned is not subject to the DRS. Furthermore, the DRS does not apply to bottles that cannot be returned by way of the reverse vending machines due to their special shapes and sizes.

In certain cases, the DRS can be applied in a flexible way.

The system is certainly flexible in that it recognises the concept of products voluntarily subject to the DRS, where a manufacturer may, at its own discretion, request the application of the system to a product (even for non-beverage packaging!) that is not otherwise subject to the DRS.

Reusability plays a role in that the deposit fee on non-reusable products subject to DRS (e.g. metal cans) is a uniform amount of HUF 50 per unit (regardless of volume and material), whereas the deposit for reusable products (e.g. glass) is set by the producer, as is also the deposit for products voluntarily subject to the DRS.

The deposit fee is already included in the price of the beverage product purchased by the consumer that is a product subject to the DRS. The fact that a consumer is buying a product subject to DRS is apparent from the external marking on the packaging of the beverage product, as the Government Decree explicitly states what marking must be on the beverage product (its packaging). If the consumer returns the packaging of a beverage product subject to the DRS to the distributor, the deposit is refunded.

Obligations of the distributor in relation to DRS

Distributors are obliged to take back returned packaging during their opening hours. In stores selling food products with a sales area of more than 400 m2 are obliged to operate reverse vending machines. In case there is no store of such size on a settlement with a population of at least 1,000, the creation of a reverse vending point is obligatory, but stores with a sales area of less than 400 m2 can also join the DRS system voluntarily.

Manufacturers pay the deposit fees to MOHU on a monthly basis: each manufacturer pays an amount calculated on the basis of the non-reusable products subject to DRS that they put on the market in a given month. Since MOHU receives the deposit fee from the manufacturer for the purpose of reimbursing the consumer when the packaging is returned, the amount of the deposit fee (as a financial assets recorded as cash accounting entry) is not included in the taxable amount of the services that MOHU would otherwise provide to manufacturers.

DRS and EPR

The DRS affects the EPR rules to the extent that no EPR fee is payable by the manufacturer with respect to such products subject to mandatory DRS for which there is an obligation to pay the deposit fee. This means that already in the very first quarter of 2024 (but at the latest when the data for this period is reported, i.e. in April), there will be a significant question as to who is subject to both the DRS and the EPR. Generally speaking, although the DRS will affect significantly fewer economic operators than the EPR, it will also involve considerably more administration and preparation in advance.

The impact of the DRS on VAT

For the purposes of Act CXXVII of 2007 on Value Added Tax (“VAT Act”), a non-reusable products subject to DRS are those non-reusable product subject to DRS according to the definition in the Government Decree that have been placed on the market as such. This is important because the VAT Act does not lay down specific rules for products placed on the market before the entry into force of the Government Decree.

Under the amendment to the VAT Act in force since 1 January 2024, the HUF 50 deposit fee is not part of the taxable amount of the supply, i.e. no VAT liability arises on it. The Government Decree stipulates that the deposit fee must be shown separately from the consideration for the beverage product (as an item outside the scope of VAT) on the invoice or receipt issued for the supply of the product.

In line with the above, the deposit fee cannot be deducted from the taxable amount when the packaging of such a beverage product is returned and the deposit fee is refunded. If, however, the packaging of a product is not returned, such a case is classified as a supply of goods under the VAT Act: the difference between the total quantity of non-reusable products subject to the DRS placed on the market in a given calendar year and the total quantity returned in that calendar year gives rise to a tax liability, which tax is paid by MOHU.

* * *

Although the introduction of the DRS system is basically intended to make the environment cleaner, it is nevertheless another very heavy administrative burden for many businesses. If you are uncertain about how you or your company will be affected by the DRS, or if you have any questions about the detailed rules, our tax experts are at your disposal.

This newsletter is based on the information available at the date of its publication and is written for general information purposes only; therefore, it does not constitute or replace personalised tax advice in any respect.

On 30 November 2023, Act LXXXIII of 2023 on the amendment of certain tax laws and Act LXXXIV of 2023 on additional taxes to ensure a global minimum tax level and amending certain tax laws in this context (hereinafter jointly: the Autumn Tax Package) were promulgated.

The Autumn Tax Package proposes to make comprehensive changes to the Hungarian tax system and introduces a number of new legal institutions. In order to provide a more detailed and comprehensive picture of the changes, the Autumn Tax Package is presented in a series of professional publications, this sixth part of which is devoted to the rules of global minimum tax. (The first part on corporate tax is available here, the second one on tax administration here, the third on VAT here, the fourth one on personal income tax, social contribution tax and social security contribution here, and the fifth part on other taxes here.)

In accordance with the relevant European Union Directive (No. 2022/2523), one of the most significant international tax-related changes of recent years, the global minimum tax, has now been introduced into Hungarian law.

The global minimum tax affects the largest companies

In line with the practice of previous decades, many companies have taken advantage of loopholes in certain regulations to pay their taxes in countries where it is most financially advantageous for them to do so.

The concept of the global minimum tax was born out of the desire of individual states to prevent large international companies (typically, but not exclusively, digital technology giants such as Apple, Facebook or Google) from choosing their tax residence in such a way that their profits are taxed in countries with the lowest rates.

This is reflected in the “personal scope” of the global minimum tax: it will only apply to groups of companies with annual revenues above EUR 750 million (around HUF 285 billion) (to be calculated on the basis of the consolidated financial statements of the ultimate parent company) and will apply from tax years 2024 and 2025.

The EUR 750 million threshold must be examined for the 4 years preceding the given tax year: if a group exceeds this threshold in at least 2 years, it will be obliged to take into account the minimum tax rules when determining its tax liability.

Exemption from the global minimum tax

The law defines a number of entities that are excluded entities and thus exempted from the global minimum tax.

Company groups will only have to pay the minimum tax in countries that are so-called “low tax jurisdictions”, but only if one of the group’s members (not necessarily the parent company) has its tax residence there. If company group has no member resident in such a state, then the group is entirely exempt from paying the minimum tax.

A low tax jurisdiction is defined as a state where the effective tax rate on the profits of the group member with tax residence is there lower than the 15% tax rate adopted as the global minimum tax.

In determining the effective tax rate on profits, it is necessary to consider not only corporate income tax but also all taxes on amounts that are considered income or profits for accounting purposes (“covered taxes”). In Hungary, in particular, covered taxes include the corporate income tax (TAO: 9%), the local business tax (HIPA: max. 2%), the innovation contribution (0.3%) and the income tax of energy suppliers (temporarily 41% in 2023). The difference between the combined rate of these taxes and the 15% defined as the minimum will be levied according to the rules of the global minimum tax.

Rules for determining the global minimum tax

The minimum tax rules define 3 types of methods for collecting the tax differential, in the following order:

- a Qualified Domestic Minimum Top-Up Tax (“QDMTT”; from 1 January 2024), which may be collected by the country of under-taxation;

- the Income Inclusion Rule (“IIR”; from 1 January 2024), which may be applied by the country of the parent company; and

- the Undertaxed Profit Rule (“UTPR”; from 1 January 2025) which may be applied by the countries of the group members if the country of the parent company has not introduced the IRR rules or the parent company is an excluded entity.

In addition to the actual tax liability, the rules also allow for deferred taxes to be taken into account, in connection with which the Hungarian Accounting Act was also amended, as reported in our previous newsletter.

As with the Country-by-Country Report (CbCR), group members will be required to file an annual return for the minimum tax (within 12 months of the start of the tax year), while the tax return and any payment obligation will have to be filed within 15 months of the last day of the tax year, except for the transitional year 2024, when the deadline will be extended until the end of the 18th month.

The legislation provides for special deductions and exemptions at several points, which can have a significant impact on the tax burden of businesses. In addition, previous tax reliefs will continue to apply, but these will not be recognised as qualified tax reliefs.

* * *

Although the rules will only burden companies with the highest turnover, it will (also) impose a significant administrative burden on them. If you are uncertain about the conditions, the country-specific exemptions, or you would like to entrust the administration of the global minimum tax to professionals, our tax experts are at your and your company’s disposal!

This newsletter is based on the information available at the date of its publication and is written for general information purposes only; therefore, it does not constitute or replace personalised tax advice in any respect.

On 30 November 2023, Act LXXXIII of 2023 on the amendment of certain tax laws and Act LXXXIV of 2023 on additional taxes to ensure a global minimum tax level and amending certain tax laws in this context (hereinafter jointly: the Autumn Tax Package) were promulgated.

The Autumn Tax Package proposes to make comprehensive changes to the Hungarian tax system and introduces a number of new legal institutions. In order to provide a more detailed and comprehensive picture of the changes, the Autumn Tax Package is presented in a series of professional publications, the present, fifth part of which is devoted to changes related to the small business tax, energy suppliers’ income tax, public health products tax, public utility lines tax, advertising tax, retail sales tax, local taxes, property transfer tax and the contributions to be paid by airlines (the first part on corporate tax is available here, the second one on tax administration here, the third part on VAT here, and the fourth part on changes in personal income tax, social security tax and social security contributions here).

Small business tax (“KIVA”)

The Autumn Tax Package adds some new cases in which companies cease to be subject to KIVA from 1 December 2023. KIVA taxpayer status will end on the day before the date of the change of form if the private limited company changes its legal form to a public limited company.

According to the basic rule, a company cannot choose KIVA within 24 months after its KIVA taxpayer status ended. However, under the Autumn Tax Package, from 1 December 2023, KIVA may be chosen again if the taxpayer lost its KIVA status earlier due to a merger or de-merger that does not qualify as a preferential transformation as defined in Corporate Income Tax Act (i.e. in case the transformation took place at book value), which the taxpayer notified to National Tax and Customs Administration (hereinafter: “NAV”) within 15 days after the date of the merger or de-merger (and provided that the taxpayer meets the conditions for becoming a KIVA tax subject). In this case, the unused carry-forward of accrued losses (in proportion to the share in the balance of assets) may be carried forward.

Income tax of energy suppliers

For the purpose of legislative harmonisation, the rules on tax relief for investments and renovations for energy efficiency purposes will be amended in the Act on improving the competitiveness of district heating, and a new energy efficiency allowance for buildings will be introduced. The changes to the corporate income tax relief for energy efficiency investments and renovations are discussed in our first professional publication on the Autumn Tax Package, which focuses on corporate income tax.

Public health product tax

The Autumn Tax Package elevates to the level of Act of Parliament the government decree in force during the state of emergency (Government Decree 441/2023 (IX. 27.) on the different application of Act CIII of 2011 on the Public Health Product Tax during a state of emergency). The definitions of recreational and leisure sports, as well as health promotion programmes is amended, the latter of which is defined as activities, programmes, campaigns and investments supported by the work organisation of the minister responsible for the Active Hungary programme from the allocation made for this purpose. NAV transfers the amount offered by taxpayers to finance the Active Hungary programme to the appropriation for the support of these programmes, and informs the minister responsible for Active Hungary of the amount offered.

Tax on public utility lines

From 1 January 2024, the Autumn Tax Package removes communication lines from the scope of the public utility lines tax. Subsequently, from 1 January 2025, Act CLXVIII of 2012 on the tax on public utility lines will be repealed, and thereby this tax type will be abolished.

Advertising tax

The Autumn Tax Package extends the end date for the suspension of the advertising tax by another year. Therefore, until 31 December 2024, the tax rate will remain 0% of the total tax base.

Retail sales tax

The Autumn Tax Package enacts the rules applicable to the assessment of the retail sales tax for tax years shorter than 12 months, which were previously regulated by a government decree. In the case of a fraction of a year, the taxable amount must be annualised, and this annualised amount is to be used to determine the calculated annual taxable amount for 12 months, based on the bands in the scale of rates. The tax payable is a proportion of the annual tax thus calculated in relation to the calendar days of the tax year.

Local taxes – Tourism tax

As of 1 January 2024, the Autumn Tax Package adds to the group of relationships subject to public service obligations the obligation performed under a legal relationship subject to the Act on special status bodies and the status of their employees, as well as employment in public education as defined in the Act on the new career system of teachers. This means that persons employed by special status bodies and those employed in public education are exempted from paying the tourism tax when they are staying in commercial accommodations in territory of a municipality in connection with the performance of their duties.

Local taxes – Local business tax (“HIPA”)

The deposit return system (“DRS”) will enter into force from 1 January 2024, and therefore the definition of manufacturer and distributor were introduced in the legislation on HIPA. In the case of a manufacturer or distributor, under the Accounting Act, the deposit amount will be considered as net sales revenue when the related goods are sold, and the deposit fee is recognised as an increase in the cost of goods sold (“COGS”). The amount of the deposit fee received on the same product will then be deducted from COGS. Given that the deposit fee is charged on the basis of a provision of law, it is appropriate to treat it as a tax-neutral charge in the calculation of HIPA, and therefore the amount of the deposit fee is not to be included in either the net sales revenue or the amount of COGS when determining the tax base.

Property transfer tax

From 1 January 2024, the construction and purchase of new residential units, as well as the purchase or extension of used residential units that was implemented on a small settlement with the use of family housing benefit (hereafter: “CSOK”) will be exempted from the property transfer tax. In case of using a preferential interest rate loan under the CSOK Plus loan programme, the part of the market value of the residential unit below HUF 80 million will be exempted from the tax.

Also from 1 January 2024, the possibility to pay court procedural fees by way of duty stamp will cease. With regard to the abolition of the stamp duty, from 1 January 2024, the Autumn Tax Package will allow parties not obliged to use electronic communication in court proceedings to pay the court procedural fee by way of cash transfer order.

Contributions to be paid by airlines

The Autumn Tax Package elevates to the level of Act of Parliament the rule (previously set out in an emergency government decree) under which Israel and Turkey as flight destinations are subject to a lower contribution rate. Thus, when a passenger’s final destination is one of these two countries, the airline concerned will have to pay a lower contribution than for flights to other countries outside of Europe.

This newsletter is based on the information available at the date of its publication and is written for general information purposes only; therefore, it does not constitute or replace personalised tax advice in any respect.