In our experience, in 2020, both auditors and the tax authority put more emphasis on the auditing of transfer pricing between affiliates, as well as the end-of-year correction items and the existence of transfer pricing documentations, and a similar approach is also expected for 2021.

In case certain transactions between affiliated enterprises are not properly documented, the tax authority may impose a default penalty, in which case the amount of the fine may be up to HUF 2 million (EUR 5,500) per transaction, and in case of improper pricing, they may also correct the tax base and impose further fines.

Taxpayers concerned must prepare the master file and the country (local) file, and above a certain price also the country-by-country report (CbCR). The deadline for the preparation of the local (country) file is the same as the deadline for filing the corporate income tax returns.

At the same time, many companies use transfer pricing corrections at the end of the year, in case of which problems may easily arise, and therefore, we recommend very careful treatment of this issue and, in a given case, also the involvement of an expert. It is worth thinking over the following:

- was the extent of the targeted and the achieved profit sufficient?

- is the transfer pricing policy created by the group also adequate in Hungary, do the rules established comply with the local requirements?

- are all recognized expenses properly supported?

- is the accounting and tax law treatment of the end-of-year correction items suitable, and are the tax base reducing items properly justifiable?

- are there any difficulties with the timely documentation of the transaction and the use of the proper method of supporting the transfer pricing used?

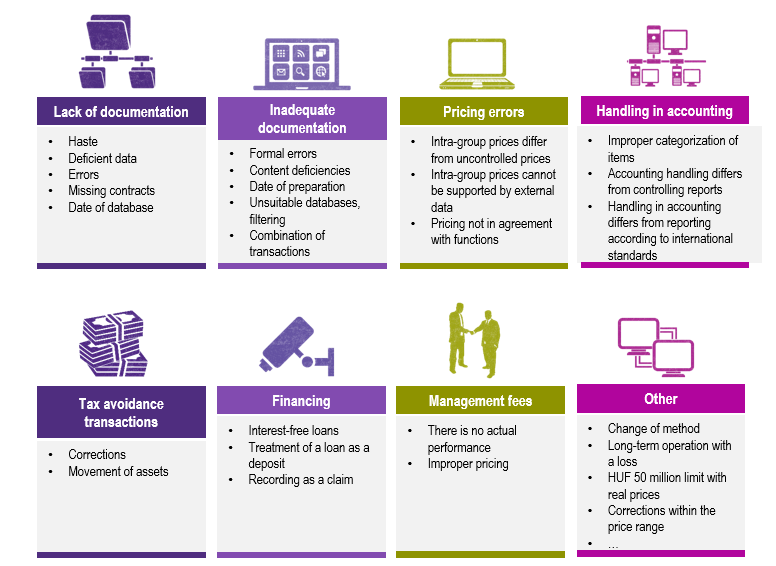

Our experts typically encounter the following, frequently occurring problems and deficiencies:

We do hope that we could be at your service with this information. Should you have any further queries, please feel free, to contact us!