An important change in connection with transfer pricing is the change in the data content of the transfer pricing information sheets (ATP sheets) of the recently published Form 2329 corporate tax return (Form 2329).

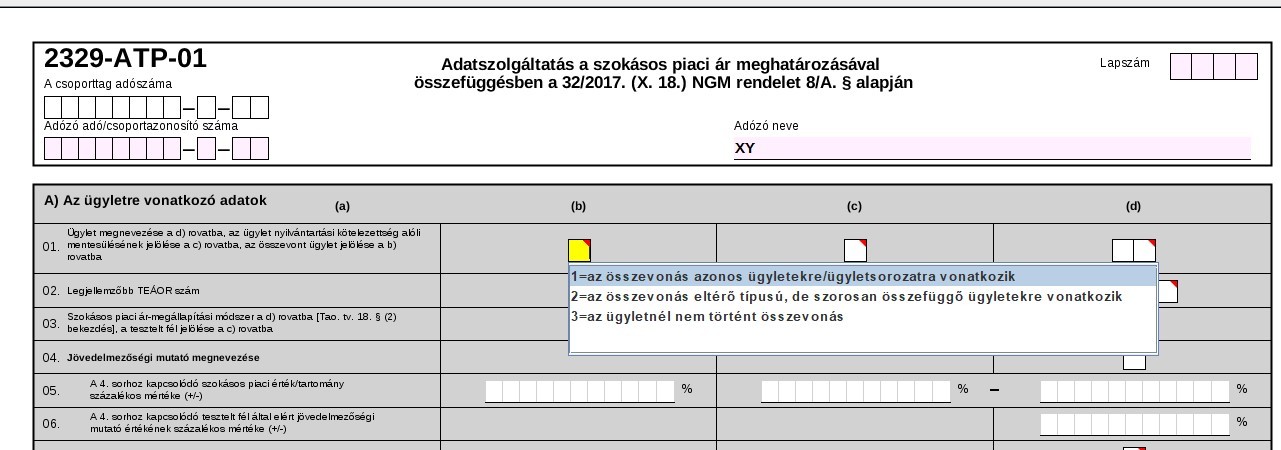

Indication of a consolidated transaction

As of 31 December 2022, purchases cannot be combined with sales of goods manufactured from purchased materials, nor can transactions involving expenses be combined with a transactions primarily involving revenues. Therefore, in their 2023 corporate tax return, taxpayers are required to indicate whether there was such combining in case of the transaction examined, and if so, whether the combining relates to identical transactions or to different types of closely related transactions.

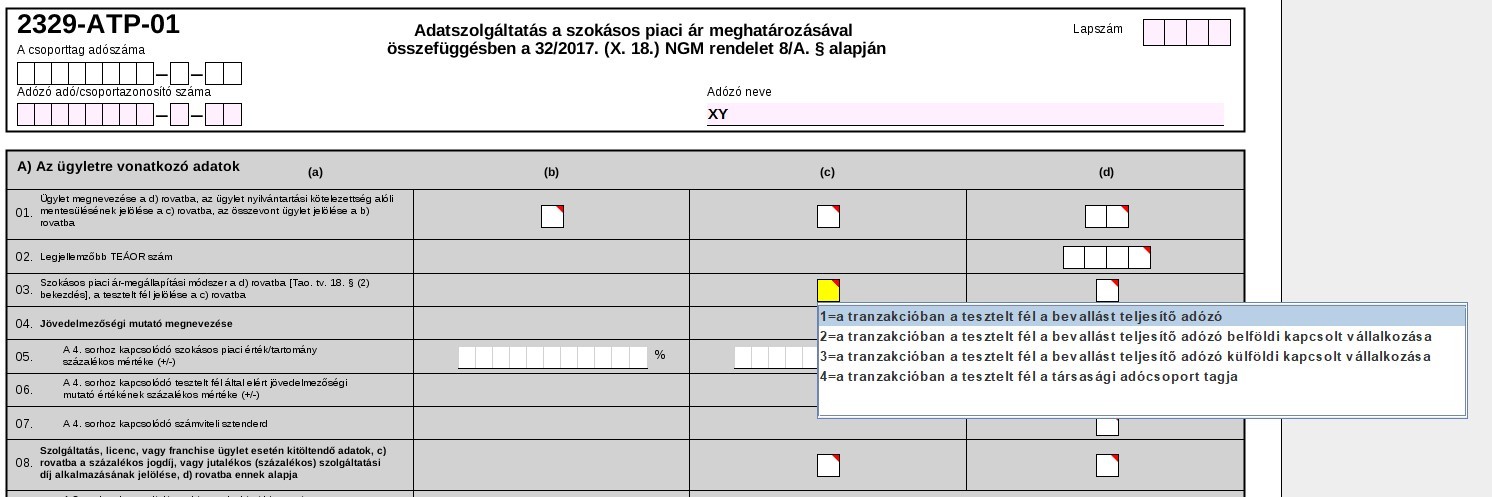

Indication of the tested party

A new element is the requirement for the taxpayer to indicate on the tax return which party is considered to be the tested party for the transaction.

Cases of cost charging

Transactions relating to the charging of the consideration for the supply of goods or services from an independent party exempted under Section 1(2), point c) of Ministerial Decree 32/2017 NGM to a related company or companies in the same value are already subject to a limited reporting obligation for the financial year 2023.

The instructions for completing Form 2329 are expected to be clarified due to the reference to Form 2429EUD.

The purpose of this post is to draw attention to the fact that this issue will have to be dealt with in the future according to a different set of criteria and that it is feared that in many cases the time available will not be sufficient if, for example, transactions in opposite directions have been combined previously.

We encourage you to review your current transfer pricing processes, and if you wish to involve experts, please do not hesitate to contact us.

Related Services

Transfer Pricing Advisory

Thanks to our fully integrated transfer pricing and valuation advisory teams, we are able to bridge the gap between tax and financial reporting aspects.